HomeBank Manages Your Home Finances Easily On Windows, Mac, And Linux

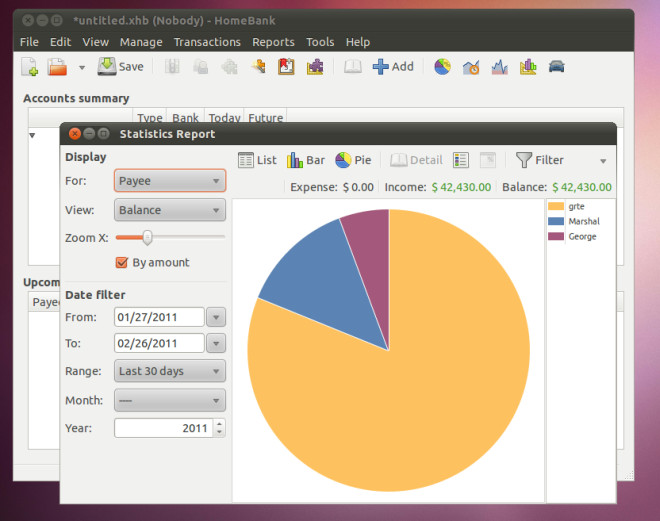

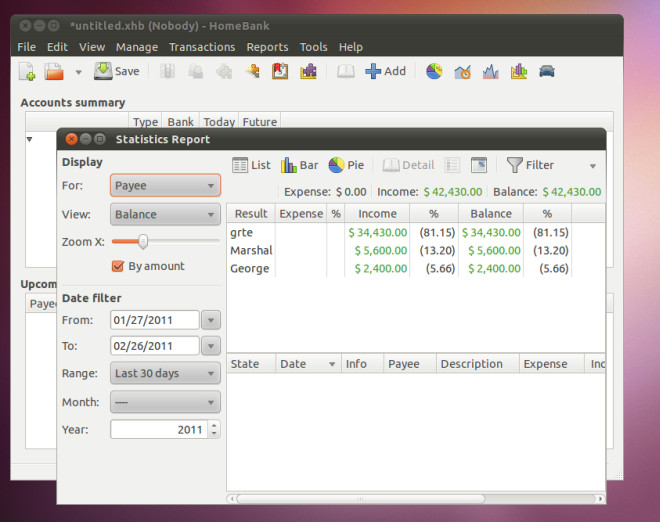

HomeBank is a home finances management tool that calculates your financial condition. It makes possible for you to get a graphical, statistical and analytical perspectives of your current financial condition, debtors or creditors. Although it is primarily a Linux based application, it also has versions for Windows and Mac. It contains a slew of powerful reporting tools which are based on filtering and graphical charts to generate a snapshot of your financial position, thus allowing you to plan ahead. HomeBank allows creating financial archives, generating graphs, applying filters to view specific statistical information, saving of financial snapshots and much more.

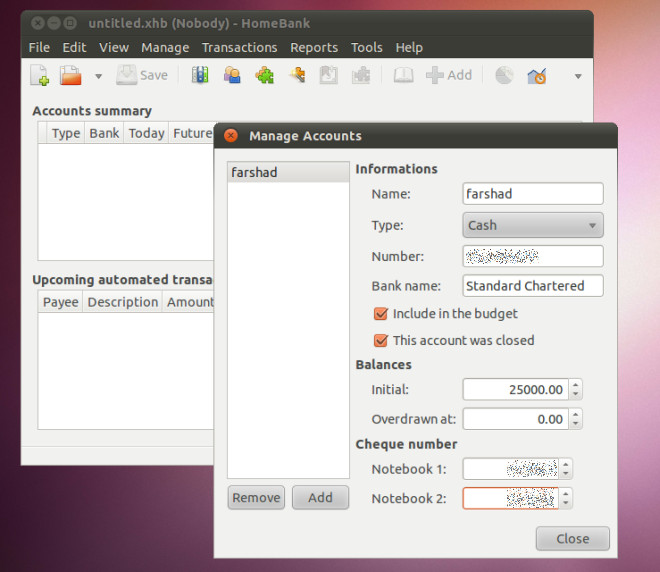

In Ubuntu, launch it from Applications –> Office. To evaluate your financial condition, add a bank account(s) and enter your financial statistics . After that you can add creditors and debtors related to the account(s) from the Transactions menu and get graphical and statistical representation of your financial position.

By adding relevant dates and stats, one can not just obtain a detailed overview of the current financial position but also a financial snapshot of past dates. You can use the statistical information to create a cash flow forecast for a small business or to manage and predict future expenses.

The available tools can be manipulated such that you can create plans, forecast, and financial information charts for small business, family members, and business partners.

In a nutshell, Home Bank provides advanced financial management options to users who are having difficultly in managing their finances. The developers claim to have created it in light of 14 years of customer feedback and I must admit that they have done a fine job. HomeBank versions can be downloaded for Ubuntu, Fedora, Debian, Open Suse, Mandriva, Maemo, Arch Linux, Mops Linux, Mac OS X and Windows.

It doesn’t say whether or not it can handle UK currencies and accounts. Why? I am not going to download something that is predominantly American am i? If someone (ieThe developer for example) could confirm that it can be adapted to the UK market i would be grateful.